Delving into Reddit’s Best Advice for Budgeting and Money Management, this introduction immerses readers in a unique and compelling narrative. Budgeting is a key aspect of effective money management, impacting personal finances in significant ways. From strategies for creating a budget to tips for saving money and managing debt, Reddit offers valuable insights and practical advice for individuals looking to enhance their financial well-being.

Join us on this insightful journey as we explore the best practices shared by the Reddit community for achieving financial stability and success.

Importance of Budgeting

Effective money management is crucial for financial stability and achieving long-term goals. Budgeting plays a key role in helping individuals take control of their finances and make informed decisions.

Benefits of Budgeting

- Tracking Expenses:By creating a budget, individuals can track their expenses and identify areas where they can cut back or save money.

- Setting Priorities:Budgeting allows individuals to prioritize their spending based on their financial goals, whether it's saving for a home, retirement, or a vacation.

- Avoiding Debt:With a budget in place, individuals can avoid overspending and accumulating debt, leading to a more secure financial future.

Impact of Not Having a Budget

Not having a budget can lead to financial instability and missed opportunities for savings and investments. Without a clear plan for spending and saving, individuals may find themselves living paycheck to paycheck, unable to reach their financial goals.

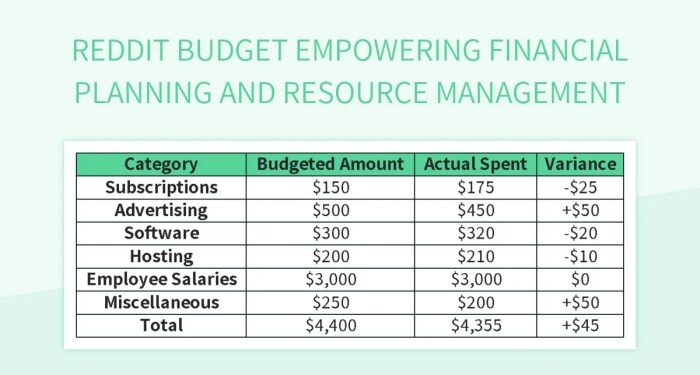

Strategies for Creating a Budget

Creating a budget is essential for effective money management. Here are some strategies to help you create a budget that works for you.

Zero-Based Budgeting

Zero-based budgeting is a method where your income minus your expenses equals zero. Every dollar you earn is allocated to a specific category, whether it's for bills, savings, or discretionary spending. This method helps you track every dollar and ensures you're not overspending.

50/30/20 Rule

The 50/30/20 rule suggests allocating 50% of your income to needs (such as rent, groceries, and utilities), 30% to wants (like dining out, shopping, and entertainment), and 20% to savings and debt repayment. This rule provides a simple guideline for balancing your budget and prioritizing different financial goals.

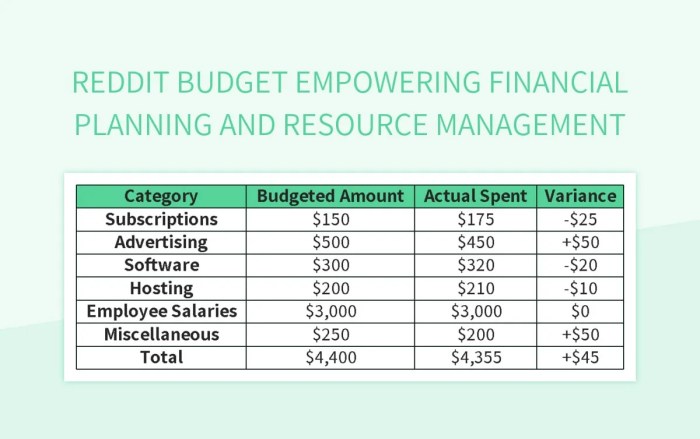

Tracking Expenses and Income

To create an accurate budget, it's crucial to track your expenses and income regularly. Use budgeting apps, spreadsheets, or pen and paper to record all your financial transactions. By monitoring where your money goes, you can identify areas where you can cut back and save.

Setting Realistic Financial Goals

Within your budget, it's important to set realistic financial goals that align with your priorities. Whether you're saving for a vacation, paying off debt, or building an emergency fund, establishing clear goals helps you stay motivated and focused on your financial objectives.

Remember to revisit and adjust your goals as needed to reflect changes in your financial situation.

Tips for Saving Money

To effectively save money, it is crucial to cut expenses and prioritize saving. Paying yourself first and building an emergency fund are essential strategies in achieving financial stability.

Cutting Expenses

- Avoid unnecessary expenses such as eating out frequently or impulse shopping.

- Consider negotiating bills like cable, internet, or insurance to get better rates.

- Try using coupons, buying generic brands, and shopping during sales to save on groceries and essentials.

Paying Yourself First

- Allocate a portion of your income towards savings before paying any bills or expenses.

- Automate your savings by setting up automatic transfers to a separate savings account.

- Start small if needed, but make consistent contributions to your savings to build a solid financial foundation.

Building an Emergency Fund

- Set a realistic goal for your emergency fund, typically 3-6 months' worth of living expenses.

- Contribute regularly to your emergency fund until you reach your target amount.

- Keep your emergency fund in a easily accessible account, such as a high-yield savings account, for quick access during unexpected financial challenges.

Managing Debt

Debt management is a crucial aspect of financial health that requires careful consideration and planning. By prioritizing debt repayment, negotiating lower interest rates, and understanding the impact of debt on long-term financial well-being, individuals can effectively manage their debt and work towards achieving financial stability.

Prioritizing Debt Repayment

When creating a budget, it is essential to prioritize debt repayment to avoid accumulating more interest and fees. Start by listing all debts, including the amount owed, interest rates, and minimum monthly payments. Consider focusing on high-interest debts first to minimize interest costs over time.

Negotiating Lower Interest Rates

One strategy to reduce debt burden is to negotiate lower interest rates with creditors. Contact lenders to inquire about potential rate reductions based on your payment history or credit score. A lower interest rate can help lower monthly payments and accelerate debt repayment.

Debt Consolidation

Consolidating debt involves combining multiple debts into a single loan with a lower interest rate. This can simplify repayment by having only one monthly payment to manage. However, it is essential to compare consolidation options carefully and ensure that the new loan terms are favorable.

Impact of Debt on Financial Health

Debt can have a significant impact on long-term financial health, affecting credit scores, borrowing capacity, and overall financial well-being. High levels of debt can lead to financial stress and limit future financial opportunities. By effectively managing debt, individuals can improve their financial outlook and work towards achieving their financial goals.

Investing and Growing Wealth

Investing is a crucial component of any financial plan as it allows individuals to grow their wealth over time through strategic decisions. By investing wisely, individuals can potentially earn returns that outpace inflation and help them achieve their long-term financial goals.

Investment Options Based on Risk Tolerance

- For individuals with a low risk tolerance, conservative investment options such as bonds or high-yield savings accounts may be suitable. While these options offer lower returns, they also come with less risk.

- Those with a moderate risk tolerance may consider diversified mutual funds or ETFs, which offer a balance between risk and potential returns.

- Individuals with a high risk tolerance may opt for more aggressive investments such as individual stocks or real estate. These options have the potential for higher returns but also come with higher volatility.

Tips for Growing Wealth Through Smart Investments

- Start investing early to take advantage of compounding returns over time. Even small contributions can grow significantly over the long term.

- Diversify your investment portfolio to spread risk and maximize potential returns. Avoid putting all your eggs in one basket.

- Regularly review and adjust your investment strategy based on changing market conditions and your financial goals. Stay informed and seek professional advice when needed.

- Consider tax-efficient investment strategies to minimize tax implications and maximize your overall returns.

Final Wrap-Up

In conclusion, Reddit’s Best Advice for Budgeting and Money Management provides a wealth of information and strategies to help individuals take control of their finances and work towards their financial goals. By implementing the tips and techniques discussed, readers can pave the way for a more secure financial future.

Remember, budgeting and money management are essential skills that can lead to long-term financial stability and success. Dive into the world of Reddit’s best advice and start transforming your financial health today.

General Inquiries

How can budgeting help individuals achieve financial goals?

Budgeting allows individuals to track their expenses, prioritize spending, and allocate resources towards specific financial objectives, thereby increasing the likelihood of achieving their goals.

What are some effective strategies for saving money?

Effective strategies for saving money include cutting expenses, paying yourself first, and building an emergency fund. These tactics can help individuals create a financial cushion and prepare for unexpected expenses.

Why is investing important for growing wealth?

Investing allows individuals to grow their wealth over time by generating returns on their capital. By making informed investment decisions, individuals can increase their financial assets and work towards long-term financial security.