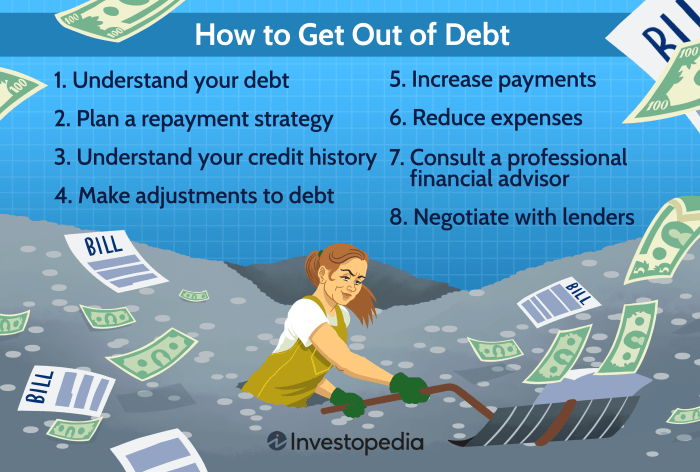

Embark on a journey to financial freedom with How to Get Out of Debt for Free: Real Strategies That Work. This guide is designed to equip you with practical tips and insights to effectively manage and eliminate debt, paving the way for a brighter financial future.

Delve into the world of debt relief, budgeting, negotiation, and more as we explore the strategies that can help you break free from the burden of debt.

Understanding Debt

Debt is the amount of money borrowed by an individual or organization from another party, with the promise of repayment at a later date. It can accumulate when expenses exceed income, leading to the need for borrowing to cover the shortfall.

Types of Debt

- Credit Card Debt: This type of debt is accrued by using credit cards to make purchases and not paying off the full balance each month.

- Student Loans: Debt taken on to finance education expenses, usually with a repayment plan after graduation.

- Medical Bills: Debt incurred from medical expenses that are not covered by insurance or other means.

Impact of Debt on Financial Health

Debt can have a significant impact on an individual's financial health, affecting their ability to save, invest, and achieve financial goals. It can lead to stress, reduced credit scores, and limited access to future credit. Managing debt effectively is crucial to maintaining financial stability and well-being.

Creating a Budget

Creating a budget is essential for managing finances effectively and getting out of debt. It helps you track your expenses, prioritize debt payments, and ensure you are living within your means.

Steps to Create a Budget

- List all sources of income: Start by listing all your sources of income, including your salary, side hustle earnings, and any other money you receive regularly.

- Track your expenses: Keep track of all your expenses, from bills to groceries to entertainment. This will give you a clear picture of where your money is going.

- Create categories: Divide your expenses into categories like housing, transportation, food, and debt payments. This will help you see where you can cut back.

- Set financial goals: Determine your financial goals, whether it's paying off debt, saving for a vacation, or building an emergency fund. Allocate a portion of your income towards these goals.

- Review and adjust: Regularly review your budget to see if you are sticking to it. Make adjustments as needed to ensure you are on track to meet your financial goals.

Importance of Tracking Expenses and Income

Tracking your expenses and income is crucial for understanding your financial situation. It allows you to identify areas where you can cut back and save more money to put towards paying off debt.

Tips on Prioritizing Debt Payments within a Budget

- Identify high-interest debt: Start by prioritizing debt with the highest interest rates, as this will save you money in the long run.

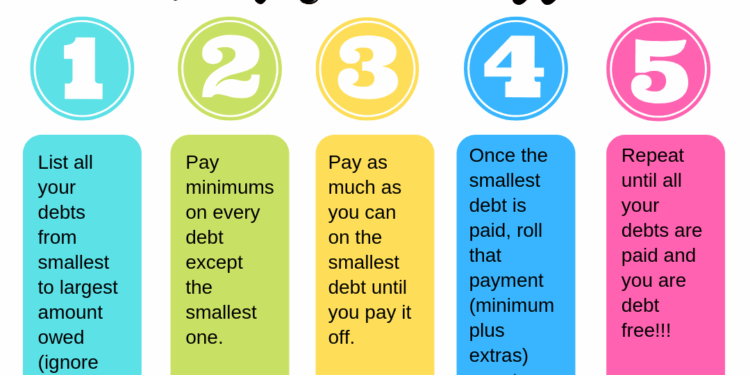

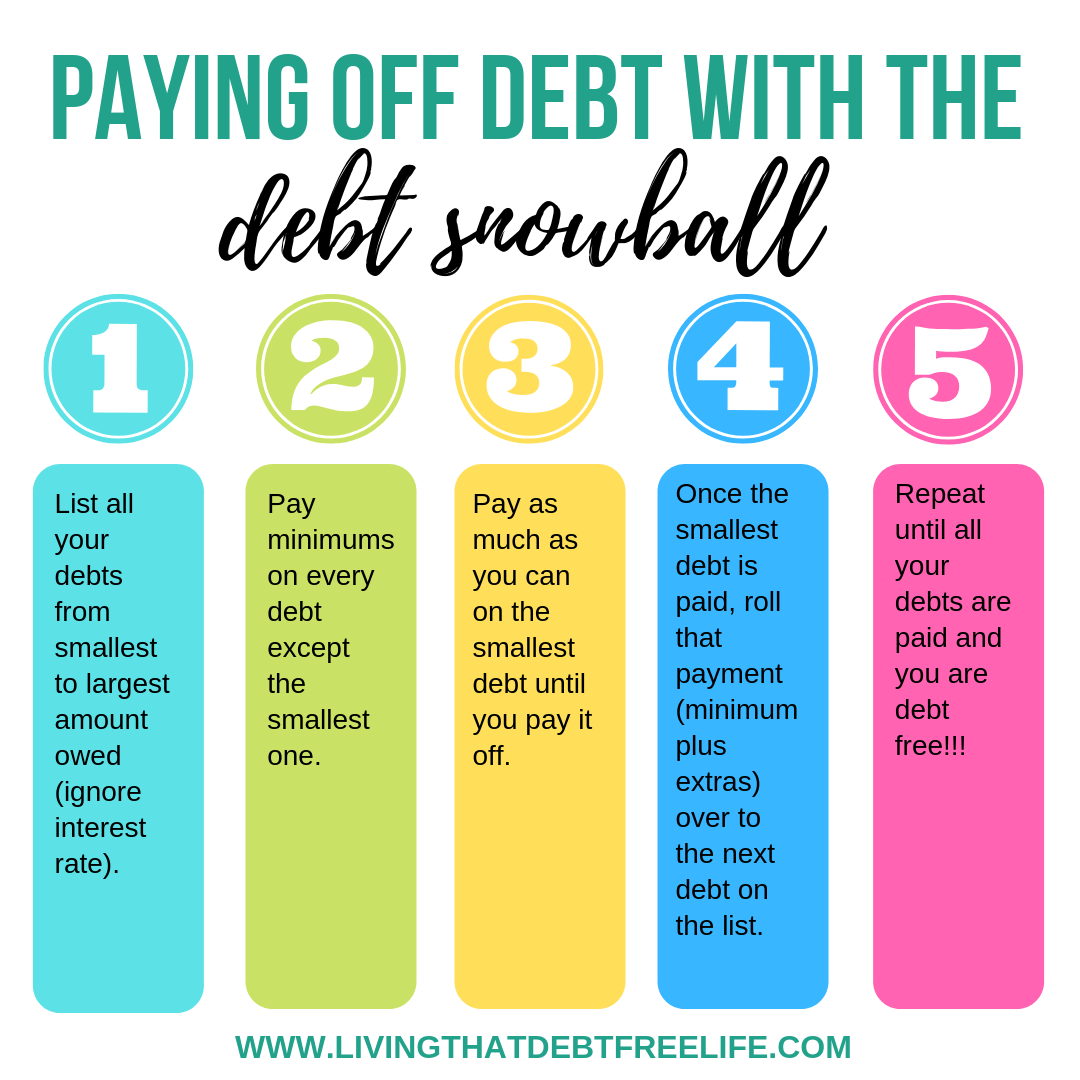

- Use the debt snowball method: If you have multiple debts, consider using the debt snowball method, where you focus on paying off the smallest debt first and then move on to the next one.

- Avoid taking on more debt: While paying off existing debt, avoid taking on more debt to prevent worsening your financial situation.

- Automate payments: Set up automatic payments for your debt to ensure you never miss a payment and stay on track with your repayment plan.

Negotiating with Creditors

When facing debt, negotiating with creditors can be a crucial step in finding relief and managing your financial situation effectively. By working with your creditors, you may be able to lower interest rates, set up a new payment plan, or even settle your debts for less than the full amount owed.To negotiate successfully with creditors, communication and transparency are key.

Be honest about your financial situation and demonstrate your willingness to work towards a solution. By showing that you are proactive and committed to resolving your debts, creditors may be more inclined to cooperate and offer you options that can help alleviate your financial burden.

Strategies for Negotiating with Creditors

- Initiate contact with your creditors: Reach out to your creditors as soon as you realize you are struggling to make payments. Explain your situation clearly and inquire about any potential relief programs or options available.

- Propose a realistic payment plan: Present a payment plan that you can afford based on your current income and expenses. Be prepared to provide documentation to support your proposal.

- Ask for a lower interest rate: Request a lower interest rate to reduce the overall amount you owe. Highlight any positive changes in your financial situation or credit history that may warrant a rate reduction.

- Consider debt settlement: If you are unable to pay the full amount owed, you may negotiate a settlement with your creditors to pay a reduced sum as a final payment. Make sure to get any agreement in writing before making a payment.

- Seek professional help if needed: If you are unsure how to negotiate with creditors or feel overwhelmed by the process, consider seeking help from a credit counseling agency or a financial advisor.

Exploring Debt Relief Options

When facing overwhelming debt, exploring debt relief options can provide a path towards financial freedom. There are several common strategies individuals can consider, each with its own set of pros and cons. It's essential to understand these options thoroughly to make an informed decision.

Debt Management Plans

A debt management plan involves working with a credit counseling agency to negotiate lower interest rates or monthly payments with creditors. This can help streamline payments and make them more manageable.

- Pros:

- Consolidates multiple debts into one payment

- Lowers interest rates

- Provides a structured plan for debt repayment

- Cons:

- May require closing credit accounts

- Could impact credit score

- May involve fees from credit counseling agencies

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can simplify payments and potentially save money on interest over time.

- Pros:

- Simplifies debt repayment

- Lowers overall interest rates

- May reduce monthly payments

- Cons:

- Requires a good credit score to qualify for favorable terms

- Could lead to accruing more debt if spending habits are not addressed

- May involve fees or closing accounts

Debt Settlement

Debt settlement involves negotiating with creditors to settle debts for less than what is owed. This can be a more drastic option but can provide significant debt reduction for those in dire financial situations.

- Pros:

- Significantly reduces overall debt amount

- May provide a faster path to debt freedom

- Settlements are typically less than the full debt amount

- Cons:

- Can negatively impact credit score

- Requires a lump sum payment for settlements

- May involve tax implications on forgiven debt

Choosing the Right Debt Relief Option

When considering debt relief options, it's crucial to assess your financial situation carefully. Factors such as total debt amount, income, credit score, and future financial goals should all be taken into account. Consulting with a financial advisor or credit counselor can help you navigate the complexities of each option and choose the best fit for your circumstances.

Increasing Income and Cutting Expenses

Increasing income and cutting expenses are crucial steps in getting out of debt. By finding ways to earn more money and reducing unnecessary spending, you can allocate more funds towards paying off your debts and achieving financial freedom.

Ways to Increase Income

- Consider taking on a side hustle or part-time job to supplement your main income. This could involve freelance work, consulting, or offering services in your area of expertise.

- Sell unused items or belongings that you no longer need. Platforms like eBay, Facebook Marketplace, or local buy/sell groups can help you turn clutter into cash.

- Explore passive income opportunities such as renting out a spare room on Airbnb, investing in dividend-paying stocks, or creating digital products like e-books or online courses.

Strategies for Cutting Expenses

- Create a budget and track your spending to identify areas where you can cut back. This could include dining out less, reducing subscription services, or finding cheaper alternatives for everyday expenses.

- Negotiate with service providers to lower monthly bills or seek discounts. Many companies are willing to work with customers to find cost-saving solutions.

- Shop smart by using coupons, buying generic brands, or taking advantage of sales and promotions. Planning meals ahead of time and avoiding impulse purchases can also help reduce expenses.

Creating a Sustainable Financial Plan

- Set specific financial goals and milestones to track your progress. Whether it's paying off a certain amount of debt each month or saving for a future expense, having clear objectives can keep you motivated.

- Build an emergency fund to cover unexpected expenses and avoid going further into debt. Having savings set aside for emergencies can prevent you from relying on credit cards or loans in times of need.

- Review your financial plan regularly and make adjustments as needed. Life circumstances and priorities may change, so staying flexible and proactive in managing your finances is essential for long-term success.

Last Point

As we wrap up our discussion on How to Get Out of Debt for Free: Real Strategies That Work, remember that financial freedom is within reach. By implementing the right tactics and staying committed to your goals, you can take control of your finances and build a secure future free from debt.

FAQ Section

How can I negotiate with creditors effectively?

To negotiate effectively, prepare by understanding your financial situation, be honest with your creditors, and propose a reasonable repayment plan. Communication and transparency are key.

What are some practical ways to increase income?

Increasing income can be done through side hustles, freelancing, or selling unused items. Explore opportunities that align with your skills and interests.

How do I choose the right debt relief option for my situation?

Consider factors such as the amount of debt, your income, and financial goals. Research different options like debt management plans or debt consolidation to find the best fit.