Delving into the realm of Debt Consolidation Explained: How MMI Can Help You, the following discourse aims to shed light on this financial strategy in a captivating manner, offering insights that are both informative and engaging.

The subsequent paragraph will provide a detailed and coherent exploration of the subject matter.

Introduction to Debt Consolidation

Debt consolidation is a financial strategy that involves combining multiple debts into a single loan or payment. This can make it easier to manage and pay off debts, typically by lowering the overall interest rate and monthly payments.

Types of Debt Consolidation Methods

- Balance Transfer:This method involves transferring high-interest credit card balances to a new credit card with a lower interest rate.

- Debt Consolidation Loan:A new loan is taken out to pay off existing debts, consolidating them into one monthly payment.

- Home Equity Loan:Homeowners can use the equity in their home to secure a loan for debt consolidation purposes.

Benefits of Debt Consolidation

- Lower Interest Rates: Debt consolidation can often result in a lower overall interest rate, saving money in the long run.

- Simplified Repayment: Managing one monthly payment can make it easier to keep track of debts and stay on top of payments.

- Reduced Stress: By consolidating debts, individuals can feel less overwhelmed and more in control of their financial situation.

Understanding MMI (Money Management International)

MMI, also known as Money Management International, is a non-profit organization that focuses on helping individuals achieve financial wellness through various services such as financial education, counseling, and debt management.

Role of MMI in Financial Management

MMI plays a crucial role in assisting individuals with debt consolidation by providing personalized solutions to help them manage and repay their debts effectively. Their certified counselors work with clients to create a customized plan that fits their financial situation and goals.

How MMI Helps with Debt Consolidation

Through debt consolidation, MMI helps individuals combine multiple debts into a single monthly payment with lower interest rates. This simplifies the repayment process and makes it more manageable for clients to stay on track with their payments.

Success Stories with MMI

Many individuals have shared their success stories after working with MMI for debt consolidation. They have expressed their satisfaction with the personalized guidance and support provided by MMI counselors, which helped them regain control of their finances and become debt-free.

MMI vs. Other Debt Consolidation Companies

Compared to other debt consolidation companies, MMI stands out for its non-profit status, commitment to financial education, and focus on long-term financial wellness. While other companies may charge high fees or offer temporary solutions, MMI prioritizes sustainable debt management strategies that empower individuals to achieve lasting financial stability.

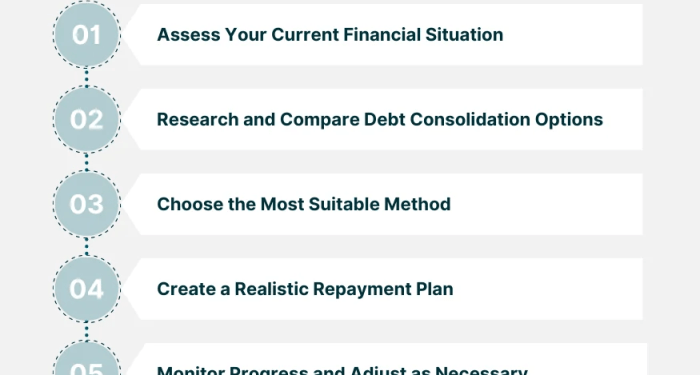

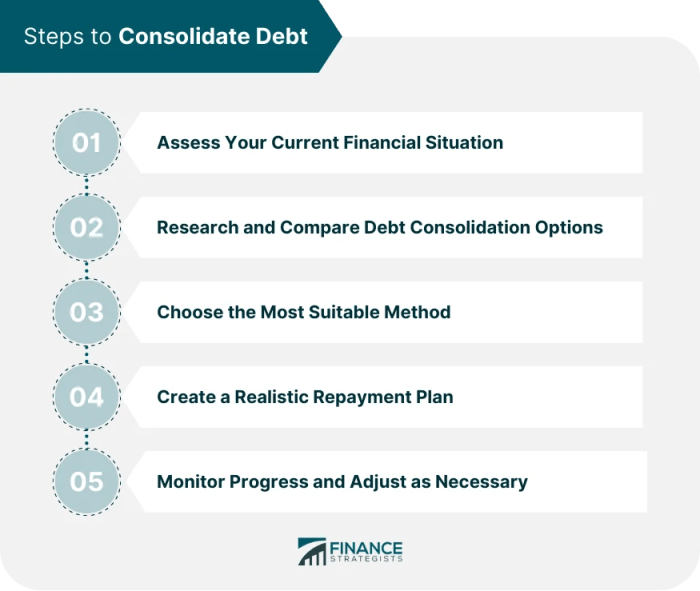

Steps to Debt Consolidation with MMI

Debt consolidation with MMI involves a structured process to help individuals manage their debts effectively and regain financial stability. By enrolling in a debt consolidation program with MMI, clients can benefit from expert guidance and support to streamline their debt repayment journey.

Enrolling in a Debt Consolidation Program

- Complete a comprehensive financial assessment to determine the best debt consolidation plan.

- Provide necessary financial documents and information to MMI for review and analysis.

- Agree to a customized debt management plan developed by MMI to consolidate and repay debts efficiently.

- Make timely monthly payments to MMI, who will then distribute the funds to creditors on behalf of the client.

MMI Negotiating with Creditors

- MMI negotiates with creditors to lower interest rates, waive fees, and create affordable repayment terms for clients.

- Through negotiation, MMI aims to reduce the overall debt burden and make repayment more manageable for clients.

- Clients benefit from MMI's expertise in dealing with creditors and resolving debt issues effectively.

Creating a Budget and Financial Plan

- Work with MMI counselors to create a realistic budget that aligns with financial goals and debt repayment strategies.

- Develop a financial plan to track income, expenses, and savings, ensuring a sustainable approach to managing finances.

- Regularly review and adjust the budget with MMI's guidance to stay on track and achieve financial stability.

Maximizing the Benefits of Debt Consolidation

- Commit to making consistent monthly payments to MMI to ensure timely debt repayment and progress towards financial freedom.

- Take advantage of financial education resources provided by MMI to enhance money management skills and make informed financial decisions.

- Communicate openly with MMI counselors to address any challenges or concerns during the debt consolidation process.

Risks and Considerations

Debt consolidation through MMI can offer a path towards financial freedom, but it's essential to be aware of potential risks and considerations before proceeding. Understanding how debt consolidation may impact your credit score and being mindful of common pitfalls can help you make informed decisions for your financial future.

Potential Risks Associated with Debt Consolidation

- One risk to consider is the possibility of accruing more debt if spending habits are not addressed alongside the consolidation process.

- There may be fees associated with debt consolidation services, so it's important to fully understand the costs involved before committing.

- In some cases, debt consolidation can lead to a longer repayment period, resulting in more interest paid over time.

Impact of Debt Consolidation on Credit Scores

- Consolidating debt may initially result in a slight decrease in your credit score, but over time, making consistent payments can improve your score.

- Closing multiple accounts as part of the consolidation process could also impact your credit utilization ratio, which is a factor in determining your credit score.

Strategies for Avoiding Common Pitfalls

- Create a budget and stick to it to avoid falling back into debt after consolidating.

- Avoid taking on new debt while working towards paying off consolidated balances.

- Regularly monitor your credit report to ensure all accounts are being reported accurately post-consolidation.

Addressing Misconceptions about Debt Consolidation with MMI

- One common myth is that debt consolidation is a quick fix for financial troubles. In reality, it requires discipline and commitment to see long-term results.

- Another misconception is that debt consolidation will erase all your debt. While it can simplify payments, the debt still needs to be repaid.

Ending Remarks

Concluding our discussion with a comprehensive summary, the essence of Debt Consolidation Explained: How MMI Can Help You is encapsulated in a memorable fashion, leaving readers with a lasting impression.

Questions and Answers

What is the main goal of debt consolidation?

The primary aim of debt consolidation is to combine multiple debts into a single, more manageable payment. This can help individuals streamline their finances and potentially reduce interest rates.

Does debt consolidation impact credit scores?

While debt consolidation may initially cause a slight dip in credit scores, it can ultimately have a positive impact by reducing overall debt and improving payment history.

How long does it typically take to complete a debt consolidation program with MMI?

The duration of a debt consolidation program with MMI varies depending on individual circumstances, but it usually ranges from 2 to 5 years.

Is there a fee for enrolling in a debt consolidation program with MMI?

MMI typically charges a nominal fee for their debt consolidation services, which can vary based on the complexity of the individual's financial situation.

Can debt consolidation with MMI help in avoiding bankruptcy?

Debt consolidation through MMI can be an effective alternative to bankruptcy by providing individuals with a structured plan to repay their debts and regain financial stability.