Debt Financing vs Crowdfunding: Which Is Better for Growth? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

In this comprehensive comparison, we delve into the realm of business financing, exploring the contrasting landscapes of debt financing and crowdfunding to determine which avenue holds the key to accelerated growth and success.

Introduction to Debt Financing and Crowdfunding

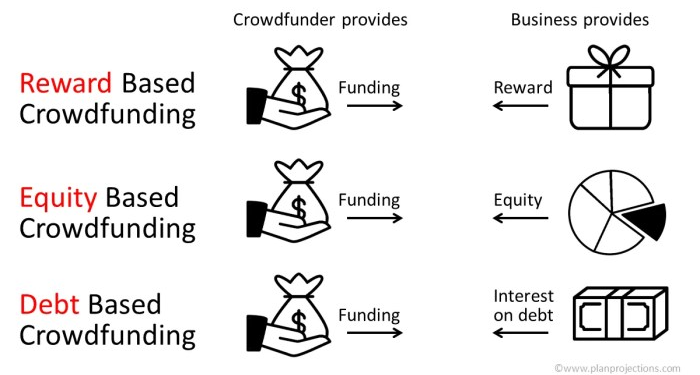

Debt financing and crowdfunding are two popular methods that businesses use to raise capital for growth. Debt financing involves borrowing money from lenders that must be repaid with interest, while crowdfunding entails raising funds from a large number of individuals or organizations online.

Both options have their own advantages and considerations when it comes to fueling business growth.

Debt Financing

Debt financing is a common method where businesses take out loans or issue bonds to secure funding for expansion, operations, or other needs. This approach allows companies to access capital quickly, but they are obligated to repay the borrowed amount with interest.

One example of successful debt financing is Apple Inc., which has utilized bonds to finance various projects and acquisitions.

Crowdfunding

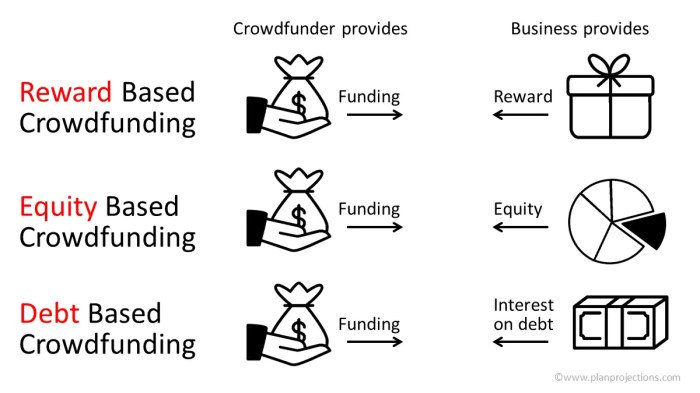

Crowdfunding, on the other hand, involves raising small amounts of money from a large number of people, typically through online platforms. This method allows businesses to gather support from a community of backers who believe in their product or vision.

A notable example of successful crowdfunding is the Pebble Time smartwatch, which raised over $20 million on Kickstarter to fund its development.

Pros and Cons of Debt Financing

When considering debt financing for business growth, it is essential to weigh the advantages and disadvantages this option presents.

Advantages of Debt Financing

- Access to Capital: Debt financing provides businesses with immediate access to funds that can be used for various growth initiatives such as expanding operations, investing in new technology, or launching new products.

- Retain Ownership: Unlike equity financing, taking on debt allows business owners to retain full ownership and control of their company without diluting their ownership stake.

- Tax Deductions: Interest payments on business loans are typically tax-deductible, which can help lower the overall tax burden for the company.

Drawbacks of Debt Financing

- Interest Payments: One of the main drawbacks of debt financing is the obligation to make regular interest payments, which can add to the overall cost of borrowing and impact cash flow.

- Risk of Default: If a business is unable to meet its debt obligations, it risks defaulting on the loan, which can lead to severe consequences such as asset seizure or legal action by creditors.

- Impact on Credit Score: Taking on too much debt can negatively impact a company's credit score, making it more challenging to secure favorable terms for future financing.

Flexibility of Debt Financing

Debt financing offers flexibility in terms of repayment schedules and control over the business. While some loans may have fixed repayment terms, others may allow for more flexible payment options based on the business's cash flow. Additionally, business owners have the autonomy to use the borrowed funds as they see fit without interference from external investors.

Pros and Cons of Crowdfunding

Crowdfunding has emerged as a popular alternative source of capital for businesses looking to fuel their growth. It offers several benefits but also comes with certain challenges that businesses need to consider.

Benefits of Crowdfunding

- Access to a wider pool of potential investors: Crowdfunding allows businesses to reach a larger audience of potential investors who may be interested in supporting their ideas or products.

- Validation of ideas: By securing funding through crowdfunding, businesses can validate their ideas or products in the market before fully launching them.

- Increased brand awareness: Crowdfunding campaigns can help businesses increase their brand visibility and attract new customers who are interested in their offerings.

- Flexible funding options: Crowdfunding platforms offer various funding models, such as rewards-based, equity-based, or donation-based, providing businesses with flexibility in choosing the right option for their needs.

Challenges of Crowdfunding

- High competition: With the increasing popularity of crowdfunding, businesses face tough competition to stand out and attract investors among a sea of other campaigns.

- Time-consuming: Running a successful crowdfunding campaign requires significant time and effort to create compelling content, engage with backers, and promote the campaign across various channels.

- Risk of failure: Not all crowdfunding campaigns reach their funding goals, and unsuccessful campaigns can damage a business's reputation and credibility in the market.

- Lack of control: Crowdfunding may involve sharing sensitive business information with a large number of investors, potentially leading to a loss of control over certain aspects of the business.

Impact on Brand Awareness and Customer Engagement

- Crowdfunding campaigns can significantly boost brand awareness by showcasing a business's products or ideas to a wide audience of potential customers and investors.

- Engagement with backers and supporters during a crowdfunding campaign can create a loyal customer base that is emotionally invested in the success of the business, leading to long-term customer relationships.

- Successful crowdfunding campaigns can generate positive buzz and word-of-mouth marketing, further enhancing brand visibility and attracting new customers to the business.

Criteria for Choosing Between Debt Financing and Crowdfunding

When deciding between debt financing and crowdfunding, businesses should carefully consider a variety of factors to determine which option aligns best with their specific goals and circumstances.

Company Size

- Smaller businesses may find it easier to qualify for crowdfunding as they can attract individual investors who are willing to support their ventures.

- Larger companies with established credit histories may have an easier time securing debt financing from traditional financial institutions.

Industry

- Some industries may be more attractive to crowdfunding investors due to their innovative or socially impactful nature.

- Debt financing may be more common in industries with stable cash flows and tangible assets that can serve as collateral.

Growth Stage

- Early-stage startups with limited operating history may find it challenging to secure debt financing and may turn to crowdfunding for initial capital.

- Established companies looking to expand or finance large projects may prefer debt financing to avoid diluting ownership through crowdfunding.

Risk Tolerance

- Businesses with a higher risk tolerance may be more comfortable with the uncertainty and potential volatility associated with crowdfunding.

- Companies seeking more predictable repayment terms and interest rates may opt for debt financing to manage risk more effectively.

Case Studies and Examples

Real-life examples can provide valuable insights into the effectiveness of debt financing and crowdfunding for business growth. Let's explore some case studies of businesses that have successfully utilized these funding methods.

Debt Financing Case Study: XYZ Company

XYZ Company, a tech startup, secured a significant loan from a bank to expand its operations and develop new products. By leveraging debt financing, the company was able to invest in research and development, hire additional staff, and scale its business rapidly.

This strategic approach enabled XYZ Company to achieve a 50% increase in revenue within a year.

Crowdfunding Example: ABC Inc.

ABC Inc., a small retail business, launched a crowdfunding campaign to raise funds for a new store location. Through a well-executed crowdfunding strategy, ABC Inc. not only met its funding goal but also generated buzz around its brand. The campaign's success attracted new customers and increased sales by 30% in the following months.

Key Strategies for Success

- Clear communication of business goals and objectives to attract investors or backers.

- Offering attractive incentives or rewards to encourage participation in debt financing or crowdfunding campaigns.

- Engaging with the community and building a strong network of supporters to drive funding efforts.

- Maintaining transparency and accountability throughout the funding process to build trust with investors or backers.

Outcome Summary

As we conclude our exploration of Debt Financing vs Crowdfunding: Which Is Better for Growth?, it becomes evident that the choice between these two financing options is not a one-size-fits-all decision. Each method presents unique advantages and challenges that businesses must carefully weigh to pave the path towards sustainable growth and prosperity.

Q&A

What are some advantages of debt financing over crowdfunding?

Debt financing typically offers lower interest rates compared to crowdfunding, making it a cost-effective option for businesses looking to expand.

How does crowdfunding impact brand awareness and customer engagement?

Crowdfunding campaigns often generate buzz around a company's products or services, leading to increased brand visibility and customer interaction.

What factors should businesses consider when choosing between debt financing and crowdfunding?

Company size, growth stage, risk tolerance, and desired level of control are key factors that can influence the decision-making process between debt financing and crowdfunding.