Kicking off with Mezzanine Debt Example: How It Bridges the Gap Between Equity and DebtRevenue Based Financing for SaaS Startups: Pros and Cons, this opening paragraph is designed to captivate and engage the readers, setting the tone casual formal language style that unfolds with each word.

Exploring the intricacies of mezzanine debt and revenue-based financing for SaaS startups opens up a world of possibilities in the realm of business financing. Let's delve deeper into how these financial tools can shape the growth and success of companies looking to navigate the delicate balance between equity and debt.

Mezzanine Debt Example

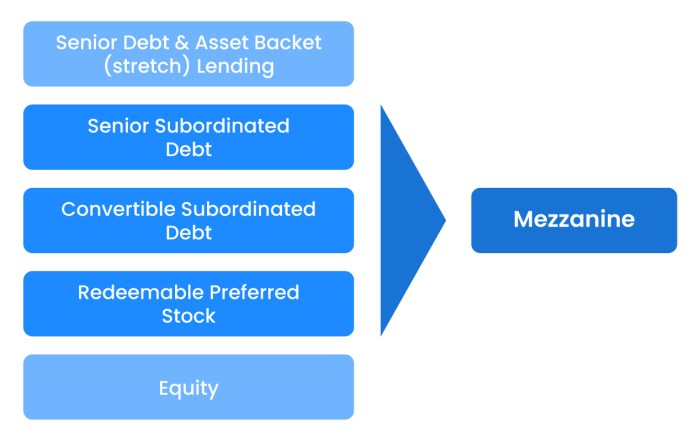

Mezzanine debt is a type of financing that combines elements of both debt and equity. It is typically used by companies to fund growth, acquisitions, or other strategic initiatives. Mezzanine debt sits between senior debt (traditional bank loans) and equity in the capital structure.

Example of Mezzanine Debt in Action

Let's consider a scenario where a technology startup is looking to expand its operations but does not want to dilute existing ownership by raising more equity. The company decides to take on mezzanine debt to finance the expansion. The mezzanine lender provides funds in the form of a loan that can be converted into equity if certain conditions are met.

- Advantages of Mezzanine Debt:

- Flexibility in repayment terms

- Higher loan amounts compared to traditional bank loans

- Potential for equity upside if the company performs well

- Interest payments may be tax-deductible

- Disadvantages of Mezzanine Debt:

- Higher interest rates compared to senior debt

- Increased financial risk due to potential equity conversion

- Complex structures and terms that may be difficult to understand

- Limited to certain types of businesses and industries

How Mezzanine Debt Bridges the Gap Between Equity and Debt

Mezzanine debt plays a crucial role in bridging the gap between equity and traditional debt financing for companies looking to raise capital. It possesses unique characteristics that make it an attractive option for businesses seeking flexible funding solutions.

Characteristics of Mezzanine Debt

- Subordinated Debt: Mezzanine debt is typically subordinated to senior debt, meaning it ranks below traditional debt in terms of priority during liquidation.

- Equity Features: Mezzanine debt often includes equity kickers such as warrants or options to purchase equity in the company, giving investors the potential for additional upside.

- Flexible Repayment: Mezzanine debt usually has flexible repayment terms, including the option to defer interest payments until maturity.

Comparison with Equity and Debt Financing

- Equity Financing: Mezzanine debt provides companies with a way to raise capital without diluting existing ownership stakes, unlike equity financing where ownership is exchanged for funding.

- Traditional Debt Financing: Mezzanine debt offers higher leverage than traditional debt but without the strict covenants and collateral requirements typically associated with bank loans.

Real-World Examples

One notable example of a company that successfully utilized mezzanine debt is XYZ Corporation. By issuing mezzanine debt, XYZ was able to fund its expansion plans without giving up control to equity investors while benefiting from the flexibility and upside potential offered by this form of financing.

Revenue Based Financing for SaaS Startups

Revenue-based financing is a funding model where a company receives capital in exchange for a percentage of its future revenues. This differs from traditional financing models like loans or equity investment, as repayment is tied directly to the company's revenue performance.

Pros and Cons of Revenue-Based Financing for SaaS Startups

- Pros:

- Flexible Repayment: Payments are based on a percentage of revenue, so startups don't face fixed monthly payments that could strain cash flow.

- No Dilution of Ownership: Unlike equity financing, revenue-based financing does not require giving up ownership stakes in the company.

- Aligned Incentives: Investors benefit from the company's growth, creating a shared goal of increasing revenue.

- Cons:

- Higher Costs: Revenue-based financing can be more expensive in the long run compared to traditional debt financing.

- Potential for Revenue Share: If the company experiences rapid growth, the total amount repaid could be higher than with a traditional loan.

- Limited to Revenue-Generating Companies: Startups that are not yet generating revenue may not qualify for this type of financing.

Examples of SaaS Startups Benefiting from Revenue-Based Financing

- Company A:Company A, a SaaS startup offering project management software, utilized revenue-based financing to fund its expansion. By tying repayment to revenue, the company was able to scale its operations without the pressure of fixed loan payments.

- Company B:Company B, a SaaS startup specializing in customer relationship management software, opted for revenue-based financing to avoid diluting its ownership through equity investment. This allowed the company to maintain control while still accessing the needed capital for growth.

Pros and Cons of Revenue Based Financing for SaaS Startups

Revenue-based financing is a popular alternative funding option for SaaS startups that offers unique advantages and disadvantages compared to traditional equity or debt financing.

Advantages of Revenue Based Financing for SaaS Startups

- Flexible Repayment: Revenue-based financing allows startups to repay based on a percentage of their revenue, aligning with their cash flow.

- No Dilution of Ownership: Unlike equity financing, revenue-based financing does not require giving up ownership stakes in the company.

- Quick Access to Capital: SaaS startups can secure funding faster through revenue-based financing compared to traditional loan processes.

- Growth Support: The funding obtained through revenue-based financing can be used directly to fuel growth initiatives and scale the business.

Drawbacks of Revenue Based Financing for SaaS Startups

- Higher Cost of Capital: Revenue-based financing often comes with higher interest rates or revenue percentages, leading to increased overall costs.

- Potential Cash Flow Constraints: The repayment structure based on revenue can sometimes create cash flow challenges for SaaS startups, especially during slow periods.

- Limits on Growth: SaaS startups may face limitations on how much they can borrow through revenue-based financing, restricting their growth potential.

Comparison with Other Funding Options for SaaS Startups

- Equity Financing: Revenue-based financing offers a way to raise capital without diluting ownership, unlike equity financing which involves giving up shares of the company.

- Debt Financing: Revenue-based financing provides a more flexible repayment structure based on revenue, as opposed to fixed payments required in traditional debt financing.

- Venture Capital: While venture capital can offer significant funding, it often comes with stringent terms and control requirements that revenue-based financing avoids.

Ending Remarks

In conclusion, the symbiotic relationship between mezzanine debt, equity, and revenue-based financing unveils a strategic approach that can propel SaaS startups towards sustainable growth and profitability. By understanding the advantages and shortcomings of these financial mechanisms, businesses can make informed decisions to optimize their financial structure and drive innovation in the competitive landscape.

Detailed FAQs

What are the key characteristics of mezzanine debt?

Mezzanine debt is a hybrid form of financing that combines elements of debt and equity, typically offering a higher interest rate and potential equity upside compared to traditional debt.

How does revenue-based financing differ from traditional financing models?

Revenue-based financing aligns repayment with the company's revenue, providing flexibility and scalability that traditional fixed-payment loans may not offer.