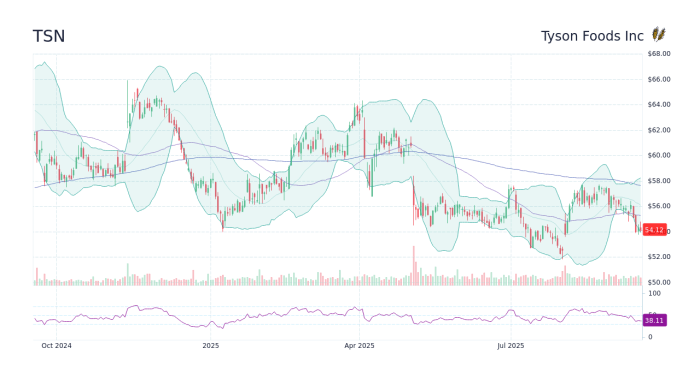

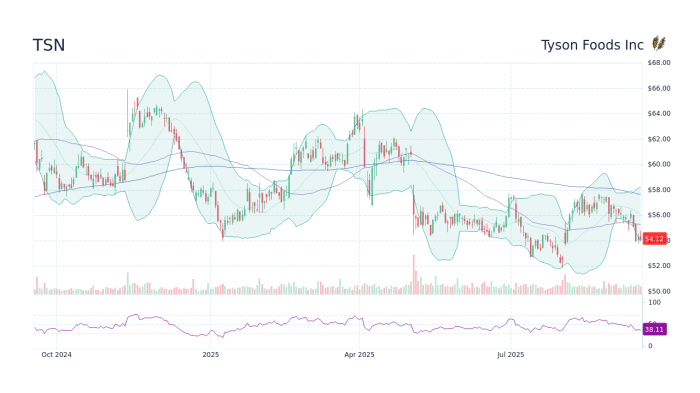

TSN Stock Analysis: Is Tyson Foods Still a Safe Investment in 2025? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The following paragraphs delve into the history, financial performance, potential risks, and future outlook of Tyson Foods as an investment option.

Introduction

Tyson Foods is a well-known American multinational corporation that operates in the food industry, specializing in chicken, beef, and pork products. The company, listed on the New York Stock Exchange under the ticker symbol TSN, has a long history dating back to 1935.

Analyzing Tyson Foods as an investment is significant due to its size and influence in the food sector, making it a key player in the stock market. Investors often look to companies like Tyson Foods for stability and growth potential, given the essential nature of food products and the steady demand for them.Key factors impacting the food industry and stock market include changing consumer preferences, global supply chain disruptions, fluctuating commodity prices, and evolving regulations.

Understanding how these factors affect Tyson Foods can provide valuable insights for investors considering the company as a potential investment in 2025.

Tyson Foods Overview

Tyson Foods is a multinational corporation and one of the largest food companies in the world. Founded in 1935 by John W. Tyson, the company has a long history of providing protein-based products to consumers globally. Tyson Foods operates in various segments such as beef, pork, chicken, and prepared foods, catering to both retail and foodservice customers.In terms of recent financial performance, Tyson Foods has shown steady growth over the years.

The company's revenue has been consistently increasing, driven by strong demand for its products. Key metrics such as earnings per share (EPS), profit margins, and market share have also been positive indicators of Tyson Foods' financial health.One recent news event impacting Tyson Foods is the increase in demand for plant-based protein alternatives.

As consumers become more health-conscious and environmentally aware, Tyson Foods has been adapting its product offerings to include more plant-based options. This shift in consumer preferences has influenced the company's strategic decisions and product development efforts.

Financial Performance

Tyson Foods reported strong financial results in the latest quarter, with revenue growth driven by increased sales in the chicken and prepared foods segments. The company's profit margins have also improved, reflecting cost-saving initiatives and operational efficiencies.

- Tyson Foods' revenue increased by X% compared to the same period last year.

- The company's earnings per share (EPS) exceeded analyst expectations, signaling strong financial performance.

- Profit margins have expanded due to effective cost management strategies implemented by Tyson Foods.

Plant-Based Initiatives

In response to the growing demand for plant-based protein alternatives, Tyson Foods has launched several plant-based product lines under brands like Raised & Rooted. The company's investment in plant-based technologies and partnerships with startups in the alternative protein space demonstrate its commitment to adapting to changing consumer preferences.

"We see plant-based protein as a key growth area for Tyson Foods in the coming years, and our initiatives in this space aim to capture a share of the expanding market."

Investment Potential

When considering Tyson Foods as an investment opportunity in 2025, several factors indicate its potential as a safe investment. Let's delve into the reasons that make Tyson Foods an attractive option for investors.

Factors Making Tyson Foods a Safe Investment

- Tyson Foods' strong market position as one of the largest food companies in the world provides stability and resilience in the face of market fluctuations.

- The company's diversification across multiple product categories, including poultry, beef, pork, and prepared foods, mitigates risks associated with fluctuations in any single market segment.

- Continuous innovation and strategic acquisitions allow Tyson Foods to adapt to changing consumer preferences and market trends, ensuring long-term growth potential.

- Efficient supply chain management and cost control measures enhance profitability and competitiveness in the industry.

Comparative Performance with Industry Competitors

- When compared to industry competitors such as Cargill and JBS, Tyson Foods has demonstrated consistent financial performance and market leadership, making it a relatively safer investment choice.

- Tyson Foods' focus on sustainability and responsible sourcing practices also sets it apart from competitors, appealing to socially conscious investors.

Risks Associated with Investing in Tyson Foods

- Volatility in commodity prices, such as feed grains and livestock, can impact Tyson Foods' production costs and profit margins.

- Regulatory changes, particularly in food safety standards and trade policies, may pose risks to Tyson Foods' operations and profitability.

- Consumer preferences shifting towards plant-based alternatives could potentially impact demand for Tyson Foods' traditional meat products, affecting revenue streams.

Future Outlook

Looking ahead to 2025, let's delve into the future projections and forecasts for Tyson Foods in the ever-evolving food industry landscape.

Industry Trends

As we move towards 2025, it's crucial to consider the prevailing trends in the food industry that might impact Tyson Foods' performance. Factors such as increasing demand for plant-based alternatives, sustainability concerns, and technological advancements in food production could shape the company's trajectory.

Upcoming Initiatives by Tyson Foods

- Tyson Foods has been focusing on expanding its presence in the alternative protein market to cater to the growing consumer interest in plant-based products. With acquisitions and partnerships in this space, the company aims to diversify its product portfolio and stay ahead of industry trends.

- The company is also investing in sustainability initiatives to reduce its environmental footprint and appeal to environmentally conscious consumers. By implementing innovative practices in sourcing, packaging, and waste management, Tyson Foods is positioning itself as a responsible player in the industry.

- Furthermore, Tyson Foods is likely to continue leveraging technology to enhance its operations and supply chain efficiency. Automation, data analytics, and AI-driven solutions could play a significant role in optimizing production processes and meeting changing consumer demands.

Sustainability and ESG Factors

Tyson Foods' approach to sustainability and ESG practices is crucial in evaluating the company's long-term performance and reputation in the market. By focusing on Environmental, Social, and Governance factors, Tyson Foods aims to create value for all stakeholders while minimizing negative impacts on the environment and society.

Environmental Initiatives

Tyson Foods has implemented various environmental initiatives to reduce its carbon footprint and promote sustainability. This includes investing in renewable energy sources, water conservation programs, and waste reduction strategies. By prioritizing environmental sustainability, Tyson Foods demonstrates its commitment to responsible corporate citizenship.

Social Responsibility

In terms of social responsibility, Tyson Foods has programs in place to support employee well-being, diversity, and inclusion. The company also engages with local communities through charitable initiatives and partnerships. By fostering a positive social impact, Tyson Foods enhances its reputation and strengthens relationships with stakeholders.

Governance Practices

Tyson Foods upholds high standards of corporate governance to ensure transparency, accountability, and ethical behavior. The company has a strong board of directors, effective risk management processes, and compliance mechanisms in place. By maintaining good governance practices, Tyson Foods builds trust with investors and other stakeholders.

Last Word

In conclusion, exploring the nuances of Tyson Foods as a safe investment in 2025 reveals a dynamic landscape filled with challenges and opportunities. As investors navigate the ever-changing world of the food industry, Tyson Foods remains a compelling choice worth considering for its stability and growth potential.

FAQs

Is Tyson Foods a reliable investment option for 2025?

Based on its historical performance and market position, Tyson Foods presents itself as a safe investment choice for 2025.

How does Tyson Foods compare to its competitors in the industry?

Tyson Foods has demonstrated strong performance compared to its industry peers, showcasing its competitive edge.

What sustainability practices does Tyson Foods follow?

Tyson Foods prioritizes sustainability and ESG practices, implementing initiatives to ensure long-term performance and responsibility.